Meeting with a mortgage lender face-to-face might give some clients a sense of security. Quicken Loans, the country’s largest home loan provider and an online lender, shows that many people don’t mind getting a loan from someone other than their bank.

Quicken Loans, which bills itself as “America’s Home Loan Experts,” has more than 30 years of expertise serving consumers in the mortgage sector. Quicken is the nation’s biggest online mortgage lender (and the second largest home loan lender overall), with offices in all 50 states and the ability to handle the whole mortgage transaction online or over the phone, including bringing the closing to you.

Quicken Loans has received several accolades in the industry, including J.D. Power’s highest customer satisfaction award for mortgage originators. Power and Associates have been named top mortgage servicers three years in a row. They’ve also received ‘Best of the Web’ accolades from prominent business journals, including Forbes, PC Magazine, and Money. All of this adds up to Quicken Loans being a great alternative for your mortgage requirements.

What is Quicken Loans all about?

If you’re looking for a new mortgage or trying to refinance over the internet, keep in mind that not all loan originators are created equal. When you apply for a loan through a site like LendingTree or Zillow, they send your request to a lot of different lenders. Quicken Loans is a direct lender.

When you choose a direct lender like Quicken Loans, you won’t get bombarded with emails from lenders vying for your business. Personal information is kept in fewer hands, which is a significant plus for privacy-conscious clients.

However, if you’re searching for a quick way to compare rates from various lenders, you might want to look at services that send your information to multiple lenders at once. The Detroit-based firm claims to be the nation’s largest mortgage lender, with $351 billion in home loans closed in 2021.

Quicken Loans Overview

Quicken routinely ranks at the top of customer satisfaction surveys, has an A+ rating from the Better Business Bureau, and boasts that 96% of its users would recommend it to others. It also received the highest customer satisfaction rating from J.D. Power. For the 11th year in a row, J.D. Power’s mortgage customer survey has ranked highest. So, how does Quicken maintain its enviable reputation?

In other words, by employing technology to streamline the mortgage application process. Quicken’s online tools are backed up by real-life mortgage specialists who are available to help over the phone or via email.

This lender, on the other hand, is not for you if you like an in-person encounter. Face-to-face encounters are not possible. Quicken also appears to favour dealing with regular clients over those who require special assistance. If your credit score is low or you have a high debt-to-income ratio, you may need to search elsewhere (DTI).

Types of Quicken Loans

- Conventional

- Jumbo

- FHA

- VA

- fixed-rate

- Adjustable-rate

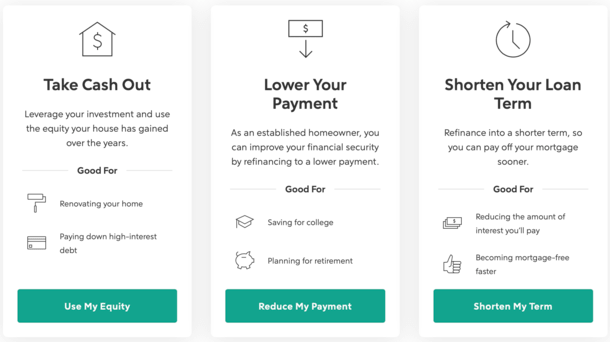

- Refinancing options include rate-and-term, cash-out, and streamline.

- Property for investment

- Flex-term

Lender Charges

An origination fee, a rate-lock fee, and other closing expenses may be charged by Quicken Loans and Rocket Mortgage. These costs may vary depending on the loan type, taxes, and other reasons.

Mortgage Interest Rates

Quicken Loans, as an online lender, offers competitive and cheap rates to consumers around the United States. Fixed-rate mortgages are the company’s most popular products, with 30- and 15-year loans available, although customers can choose any loan term from eight to 30 years with a low, fixed rate. Financially savvy people might choose adjustable-rate mortgages (ARMs) with initial terms of five or seven years in order to lower their payments.

Quicken also provides a number of mortgage packages to suit the demands of its customers. In addition to conventional mortgages, FHA and VA loans offer attractive mortgage rates and possibilities. Quicken provides jumbo loans in sums ranging from $425,100 to $3 million to customers interested in higher-value houses, all with reasonable mortgage rates and conditions.

Online Services

Quicken Loans is a pioneer in the creation of internet lending systems. Rocket Mortgage has grown in popularity in recent years as a result of its adoption of technology that allows consumers to apply for loans entirely online. The lender also executed Michigan’s first remote closing and can now conduct e-closings in all 50 states. The Rocket Mortgage app lets you e-sign your mortgage application, manage payments, and look at loan documents, just like you’d expect.

Minimum standards for borrowers

Quicken Loans and Rocket Mortgage usually follow the conforming loan standards for Fannie Mae and Freddie Mac-approved mortgages, as well as those backed by the Federal Housing Administration (FHA) and the Department of Veterans Affairs (VA). Good credit (usually a FICO score of 620 or above) and a minimum down payment of 3% are required for conventional loans. However, if you put less than 20% down, you’ll have to pay private mortgage insurance (PMI). A debt-to-income ratio (DTI) of no more than 50% is also required.

Pros & Cons

Pros

- J.D. Power gives a high ranking to customer service.

- Power

- The website and app are user-friendly.

- A national footprint and a diverse product offering

- The market leader with a well-known brand

Cons

- USDA loans, construction loans, HELOCs, and a few more items are not available.

- No physical sites exist.

- Online, there is limited information on lender costs.

- Rates and APRs may differ from national averages.

Where can you receive a Quicken Loans mortgage?

Quicken Loans provides mortgages in all 50 states, but there are no physical locations where you may apply in person. If you want to engage with this lender, you must be comfortable working with them without meeting them in person. You don’t have to use a computer or gadget after the initial encounter if you don’t want to. You can use the phone, email, fax, and postal services to request a call after submitting an online request. If you’re a first-time homebuyer who doesn’t know how to apply for a loan, talking to a loan officer over the phone could be very helpful.

Is Quicken your best option for a mortgage?

You’re not alone in choosing Quicken for your mortgage. Because of its streamlined, digital-first mortgage procedure, this Detroit-based lender has quickly become one of the most popular in the United States. But don’t pick a lender only on the basis of the convenience of application. You should also check rates from several other businesses to ensure you are getting the best bargain.

What Is the Difference Between Quicken Loans and Traditional Loans?

Quicken Loans is designed for borrowers who want to receive a loan from the comfort of their own home or even a local coffee shop. The actual procedure of applying for and completing a loan is, however, pretty comparable to that of your local bank. You have the option of applying for a loan entirely online with Rocket Mortgage.

Those who choose not to apply online have the option of working with a Rocket Mortgage Home Loan Expert. Quicken Loans then analyses your financial data and work status to determine which loan alternatives and rates you are eligible for. Before you can get a loan, the company needs to check your credit score, make sure you have enough homeowner’s insurance, and make sure you have enough money and work.

It must also commission a third-party house evaluation. Because these measures are costly, Quicken requires borrowers to submit a “good faith deposit” of $400 to $750. The good news is that the deposit is deducted from your other closing charges, so you might not wind up paying more for these fees than you would with other lenders. Quicken Loans is known for making the borrowing process as simple as possible, and their approach to mortgage closing is no exception.

Customers may choose when and where they wish to cancel their accounts simply by logging on to their accounts. Quicken claims to service 99 percent of the loans it generates, so you’ll most likely be making payments to them once you’ve closed on your property. Rocket Mortgage, an all-digital platform introduced by the company in 2014, is likely to appeal to consumers who prefer to manage their own experience. 4, When you log on to the Rocket Mortgage website or app, you’ll be asked to provide information about your finances as well as the type and amount of the loan you’re seeking.

Many customers may have their pay stubs and bank statements retrieved immediately from their financial institutions, avoiding the need to gather and deliver such papers. You may use the platform to see if you’ve been approved for a loan and to ask questions about it (though you can always pick up the phone, too). Once the loan is closed, you may log into the Rocket Mortgage website or app to manage your account and adjust payment information.

Conclusion

Quicken Loans have earned a reputation for being a quick and easy option to secure home financing. Still, doing some comparison shopping to guarantee a competitive interest rate isn’t a bad idea.