KeyBank is the single main bank and regional bank in Chicago, and that bank is the primary affiliate of KeyCorp. This one is the 25th largest bank in the US. Small businesses, merchants, investment companies, and large corporations are all represented among KeyBank’s clientele.

The financial institution is home to over 12,000 branches and more than 1,400 automated teller machines. Before you can use your KeyBank atm card for shopping or making payments, you will need to first activate it on the key.com/activate website. If you use a KeyBank card and have only just got one, you will need to activate it on this page.

Are you looking nearest keybank to me? On the page located at key.com/activate, you may find out how to activate your KeyBank login by following the instructions that are provided below.

How to Activate Your KeyBank Card

To begin, open a web browser on your mobile phone, tablet, or other device and enter the URL for the KeyBank card activation page, which is key.com/activate.

- When you reach the KeyBank card activation screen, choose the “Sign In to Activate” option from the drop-down menu.

- Pressing this button will advance you to the next screen.

- Find the space for your User ID on the next screen. Type your User ID into that space, and then click the Continue button.

- After you have typed in the password for your KeyBank online account on the next screen, click the Continue button.

- After this, you will be brought to your account.

- After you have logged into your account, you will need to finish activating your KeyBank card by following the instructions that appear on the screen.

- Be sure to have the details for your KeyBank card available so that you can finish the activation procedure.

- Because of this need, you will be required to input the details of your credit card so that it may be authenticated.

- Click the Enroll option if you do not already have a KeyBank account under your name.

After clicking this link, you will be sent to the next page, where you will need to select the type of account that you want to create from the two options that are presented: My Personal Account or My Business Account.

When you choose one of the options on the next screen, you will be asked for your Social Security Number and, if you have a My Business Account, your Social Security Number and Tax ID number.

After filling out the box with the necessary information, you will have to choose the Next option. Proceed to the next page and then follow the directions that are displayed on the screen to finish registering your KeyBank online account.

In order to finish the activation procedure for your KeyBank card, you will need to follow the instructions that were given to you when you registered for an account with KeyBank center. On the key.com/activate webpage, these are the steps that need to be taken in order for you to successfully complete the KeyBank card activation.

Activation Cards

Until your card is activated, it cannot be utilized. To activate your Key2Prepaid card, follow the guidelines provided below, which also arrived with the card:

- To activate your card, give 1-866-295-2955 a call.

- To make ATM withdrawals and retail transactions, create a 4-digit PIN.

- Sign your card’s reverse. If your card is not signed, it is not legitimate.

Using Cards

Anywhere Mastercard debit cards are accepted, you may use the Key2Prepaid card to make transactions. Your Key2Prepaid card can be used for mail-order, phone, and online transactions. Additionally, you may use your Key2Prepaid card to withdraw cash using:

- ATM withdrawal: Access your money by making free withdrawals from any KeyBank ATM. Other ATMs impose a $2.00 per cash withdrawal fee in addition to extra ATM operator costs. Go to key.com/locator to locate the closest KeyBank ATM to you.

- Withdrawal through a branch or teller: A cash advance, or Mastercard over-the-counter cash withdrawal, is free of charge at any bank that is a part of the Mastercard network, including all KeyBank center locations.

- Cash back with purchases: Purchases at eligible retailers, such as convenience stores or grocery stores, qualify for cash back.

Online Bill Payment

You can pay your bills whenever you want and anywhere you want. Paying bills online is not only quick and easy but also risk-free and guaranteed. You can monitor and arrange your bill payments, set up regular payments, set up Pay it Faster*, and transfer money at any time using online banking at key.com or the mobile app.

Specifics Regarding the Advantages

You may make transfers, send money, pay bills online, and more, all directly from the account overview page.

- You can even get payments delivered the next business day or earlier if you use the Pay it Faster* tool.

- The Bill Pay Guarantee feature gives you the peace of mind that your payment will be received on the day that you specify.

- When a payment is due in the future, the information about the payee will already be kept, so you won’t have to input it again.

- Since the history of payments may be seen for up to twenty-four months, there is no requirement that cancelled checks be kept on file.

- Set up recurring payments in such a way that monthly invoices are sent out on their own.

- Make sure you’re always aware of when payments are due by setting up reminders to check in with you periodically.

If you use Expedite Money, you can have your payment delivered the following business day for an additional charge.

How Can I Get in Touch with KeyBank’s Customer Support?

Launch the web browser on your personal computer, and go to the KeyBank center or website. Once you are on the site of KeyBank online, you need to scroll all the way down until you reach the bottom of the page and then navigate to the area labelled “Call Us.”

In the section labelled “Call us,” you will find the following list of phone numbers:

- KeyBank’s toll-free number for customer service is 1 800 KEY2YOU (539 2968).

- Customers using TDD or TTY equipment should call 1 800 539-8336.

- For customers who need to use a relay service, the number to call is 1 866 821 9126.

Maintain easy access, at all times, to the day-to-day financial details of your company. KeyBank Business Online is a place that is made to be both easy to use and safe, with the goal of meeting the needs of small and medium-sized businesses.

Key Bank Business Online gives you the ability to:

- Checks can be deposited using your mobile device.

- You have several users and accounts at your disposal.

- Examine your recent checks and account statements.

- Move money around in different accounts.

- Pay workers and merchants using the Automated Clearing House (ACH) network.

- Pay off credit cards, lines of credit, and loans.

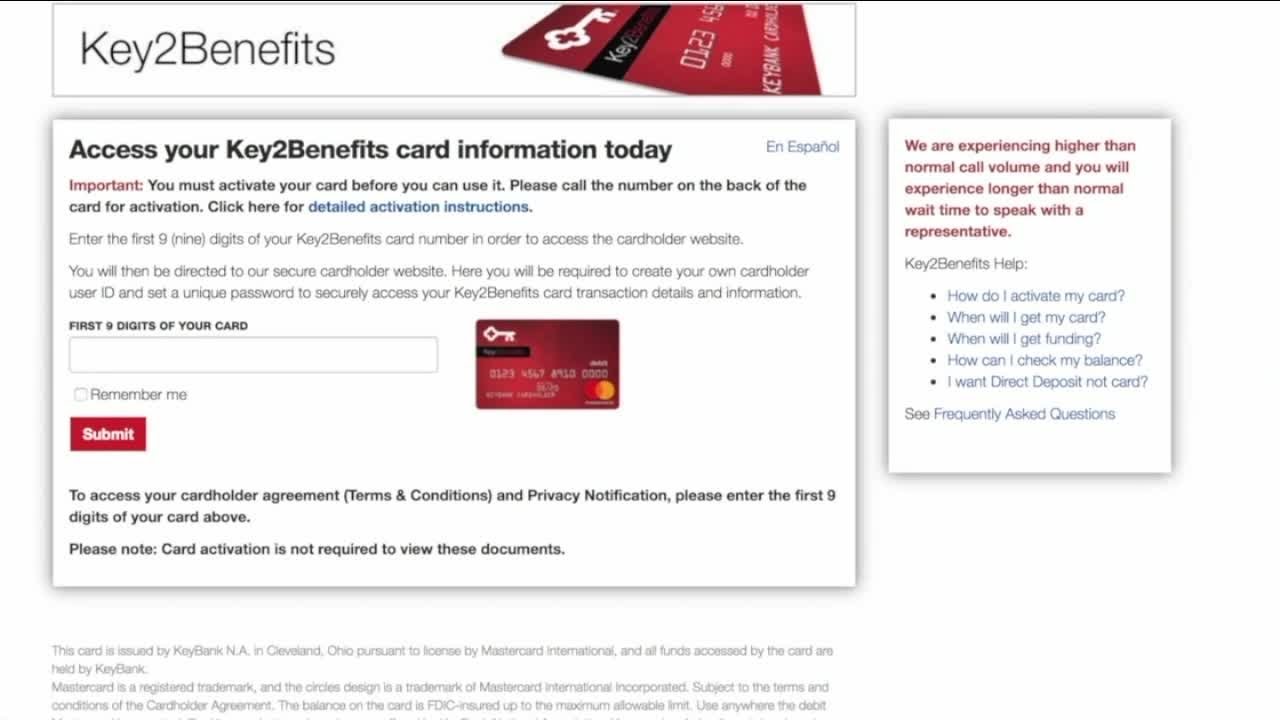

How to login to your Key2Benefits®.com Online Account

To log in and enroll, go to Key2Benefits®.com. In order to enrol in Key2Benefits.com, the Key2Benefits card you intend to use must first be activated, after which a PIN can be chosen.

If you haven’t activated your card yet, call the number on the back of the card and listen to what the voice tells you to do.

- I have activated my card, and I have set my PIN.

- Please enter the first nine digits of your card number in the space provided here.

- Click “Submit.”

- Simply select the “New User?” option from the drop-down menu.

- There is a button that says “Enroll Now!” at the bottom of the screen.

Enter your:

- 16-digit card number

- PIN Card Security Code (this may be located on the back of your card, to the right of where your signature is printed.)

- It is composed of three numerals.

- Enter the code that proves this transaction is real into the box that says “Enter the code as it appears in the darkened area.”

- Simply select “Continue” from the drop-down menu.

Once you have entered this information correctly, you will be asked to make a User ID and Password so that you can access your card information in the future.

How do I use credit cards at KeyBank ATM?

The Key Bank customer service department may be reached using this channel.

FAQ’s

Is there another way to have my KeyBank card activated?

You may also use your phone to activate your new Key Bank debit card; just dial 1-866-683-6099 and follow the instructions.

How can I sign up for notifications by text and email?

Please ensure that you have a KeyBank online banking account in order to get SMS and email alerts. To activate email and text alerts, go into your online banking account and follow the prompts.

How do I report a stolen or missing debit card?

If your debit card becomes lost or stolen, you may report it by contacting 800 539 2968 and following the on-call instructions.

On my check, where is the routing number?

On your check, in the lower left corner, is the routing number. In addition, you may get more information by calling 1-800-KEY2YOU.

I have a checking account; how can I order checks for it?

You have the following options for ordering your checks:

- banking online.

- Place an order directly with Harland Clarke, KeyBank’s chosen source of checks.

- Go to the KeyBank branch closest to you.

- Give 1 800 355 8123 a call to obtain a check.