It is more crucial than ever to have a healthy credit report and ranking, especially given the number of organizations that depend on your Credit Monitoring score to accept your applications. Credit Monitoring Services tracking helps you to keep an eye on your credit rating and score. You will obtain and reply accordingly with early notice of changes to your credit.

Credit Monitoring Services helps you recognize identity theft cases, a type of fraud that is one of the most prevalent crimes in the U.S. Credit Monitoring Services are essential to protect your credit from identity fraud and ensure that hackers don’t run up huge bills under your name and make you deal with the loss.

Pay attention to the fee when browsing around for Credit Monitoring Services. They may be free or may charge a monthly or yearly fee. You will pay special attention to the coverage that you will offer and whether the Services includes both or only one of the three Credit Monitoring Services bureaus.

You can consider all of these free alternatives if you’re not ready to spend cash for a Credit Monitoring Service. Although there are many drawbacks of signing up for a free service, including daily credit score alerts, and other subscription perks, you won’t have access to triple-bureau Credit Monitoring Services protection and identity theft policies.

What do you mean by Credit Monitoring Services?

Credit reporting systems alert you of your credit reports’ changes. You may consider signing up for one of these Credit Monitoring Services to help you keep on top of any changes to your credit file, whether you’ve been a victim of fraud or want to be vigilant.

To keep an eye on your account, a credit monitoring service is a business that typically charges a monthly fee. You fill out a user profile and sign up for updates and reminders to know when your credit score carries out some action. You will then decide whether the operation is a legal purchase that you have performed or whether fraud needs to be eliminated. With minimum effort, a Credit Monitoring Service is a fast way to track your credit and helps you to fix any problems before too much harm is done.

Best Credit Monitoring Services

Checkout Top Best Credit Monitoring Services in 2022, take a look please:

#1. IdentityForce

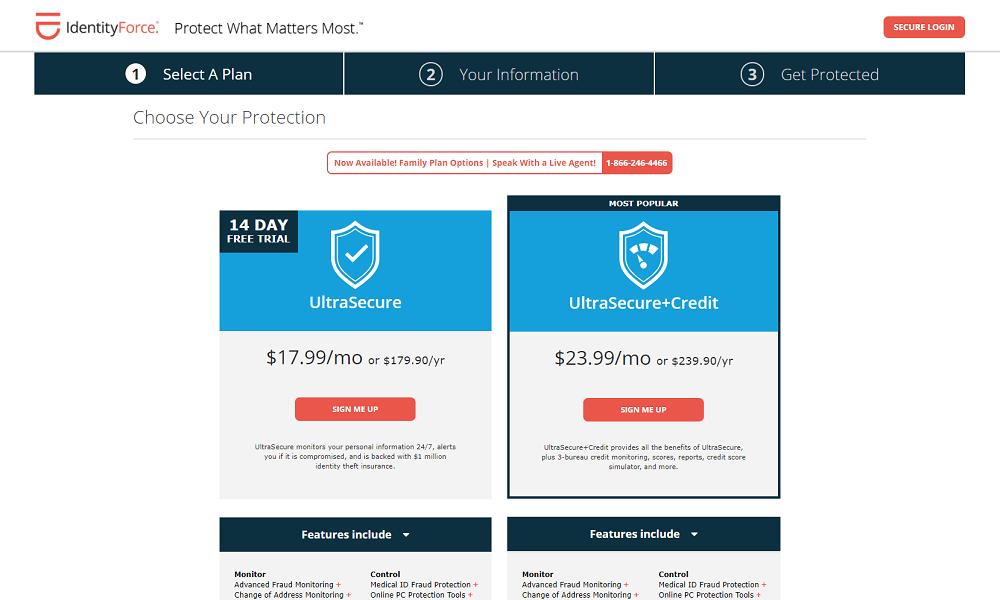

IdentityForce has two basic products for identification and credit tracking. The UltraSecure package only provides facilities for identification tracking. And both your identity and your credit are tracked by the UltraSecure+Credit plan.

For $9.99 a month and $88.99 per year, the UltraSecure package provides a host of enhancements that monitor your personal details and notify you if your data is compromised. You will also earn $1 million in identity theft insurance, which is valuable to offset identity theft-related expenses. $17.99 a month is the UltraSecure+Credit Package.

It provides all the UltraSecure Plan’s identity security functionality, including three-bureau credit reporting, credit reports, and ratings, as well as a credit simulator to show you how your credit score could be influenced by your acts.

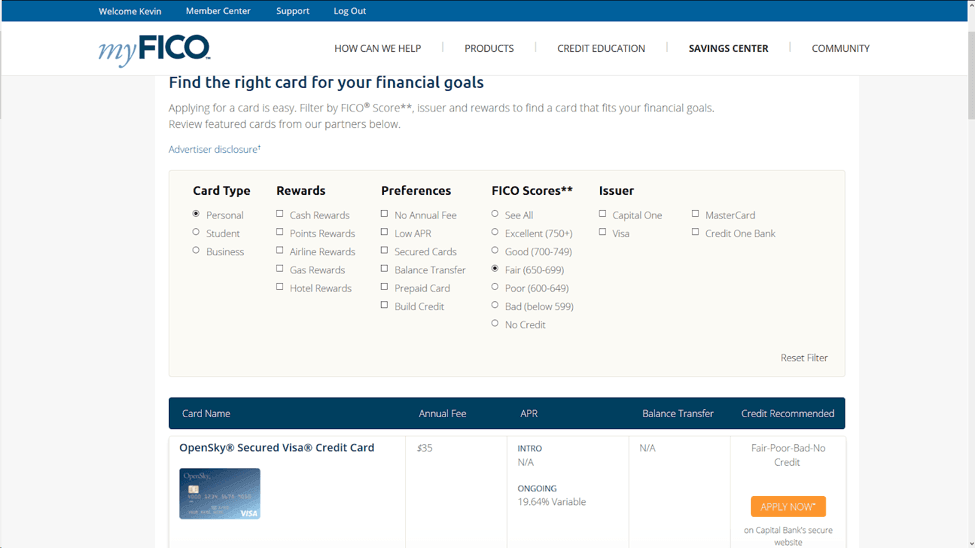

#2. myFICO Ultimate 3B Credit Monitoring

Keep eyes on the credit ratings most lenders use with the credit reporting service FICO Advanced 3B. Your three-bureau credit summary and 28 variations of your credit score that are used in mortgage, auto and credit card loans can be accessed automatically. To keep you aware of your credit status, your credit reports and ratings are updated every quarter.

Alerts will be sent to you about changes to your credit details, including newly opened accounts, new requests, new public records, new addresses, newly listed sets, and changes to your account balances. Additional warnings are issued by some credit bureaus, such as changes to the credit limits and changes to the name specified on your credit report.

A subscription to myFICO Ultimate 3B Credit Monitoring is $29.95 per month. You can cancel your subscription at any time, except for the monthly or annual subscription you have already charged, you will not get a partial refund. Monthly credit score alerts are provided by the Premier $39.95 package.

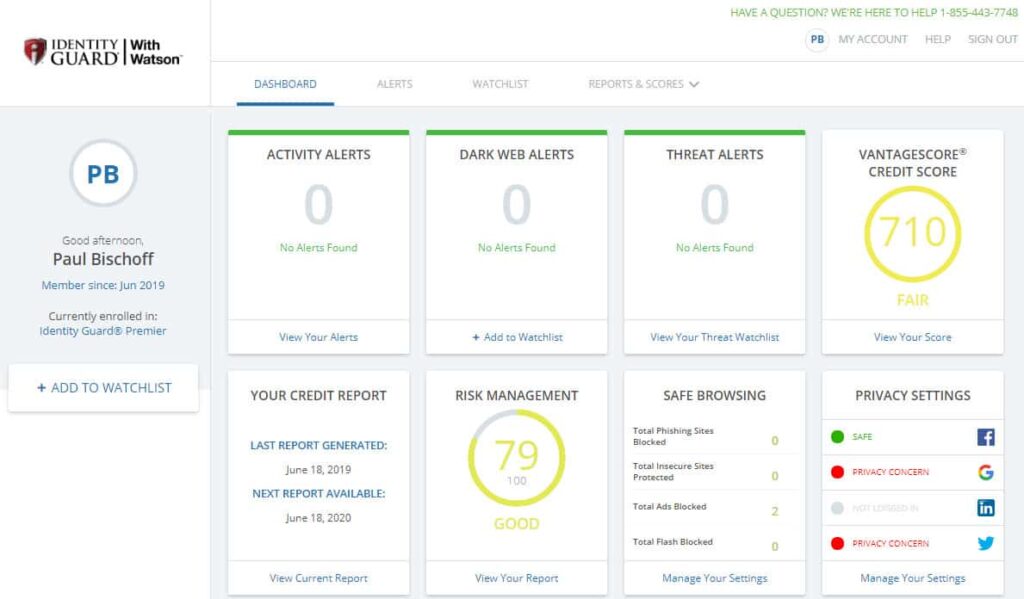

#3. Identity Guard

For more than 20 years in operation, the parent company of Identity Guard has represented over 47 million clients. The credit reporting of all three of the big credit bureaus keeps a close watch on your credit reports. You can either choose for yourself or your family between the Worth, Absolute, and Premier Plans.

Identity fraud insurance options include $1 million, a U.S.-based case manager to deal with you if your identity is compromised, a smartphone application to view your membership records, Dark Network warnings anytime your personal information is found, monthly credit score, three-bureau credit reporting and account takeover alerts. Plans for people range from $13.33 to $19.99 and $19.99 to $26/.67 for family security. Make sure you cancel before the trial expires to prevent being paid if you plan not to keep your subscription.

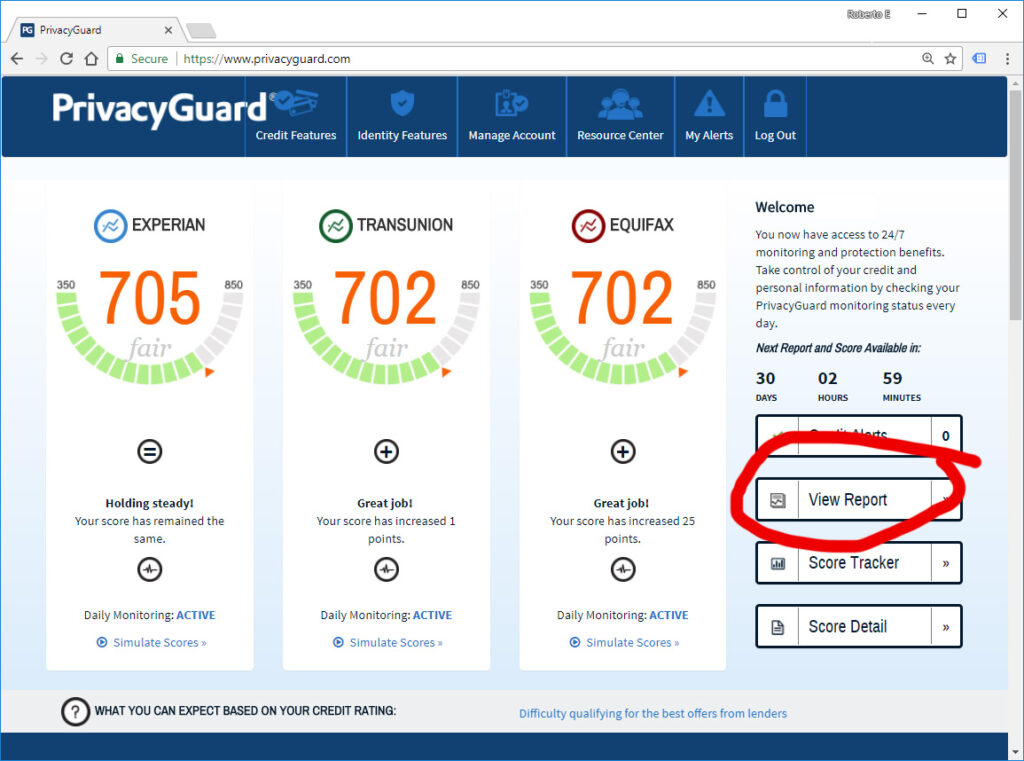

#4. Privacy Guard

For all three credit bureaus, Privacy Guard allows credit monitoring for the credit records and credit ratings. Any time your credit report details updates, regular credit tracking sends you updates via email, e-mail or phone.

For the first 14 days, you can try Privacy Guard for just $1. After that, depending on the package you chose, you will be paid the monthly subscription fee. Privacy Guard provides $9.99 a month basic ID Security. By monitoring both the internet and the Dark Web, public documents and more, ID Security monitors for signs of identity fraud.

Up to $1 million in insurance for ID fraud is included. Your three-bureau account reports and ratings, regular credit reporting and a credit score simulator provide Credit Insurance for $19.99 per month. The package for complete security is $24.99 a month which covers all of the Credit Protection and ID Protection Plans’ functions.

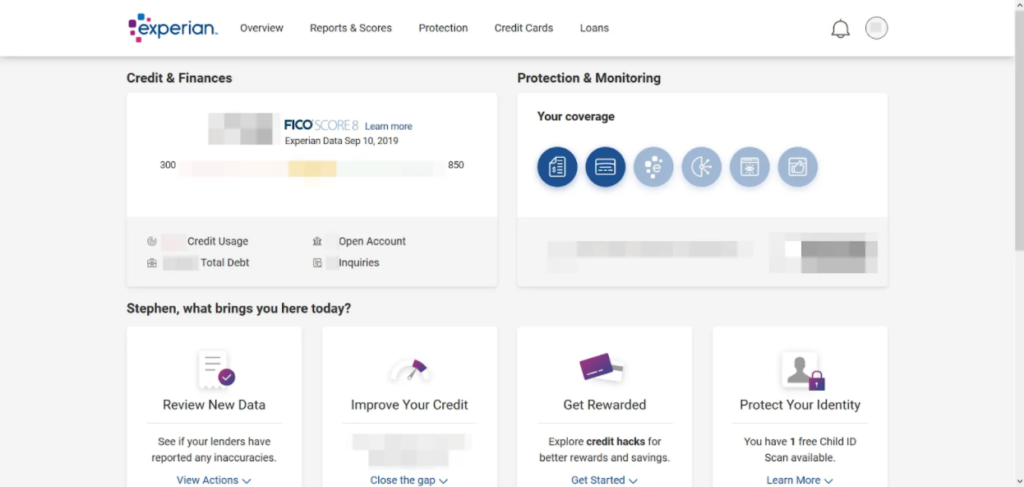

#5. Experian IdentityWorks

One of the best credit bureaus, Experian, provides a credit Experian IdentityWorks reporting that checks all three of the credit records. IdentiyWorks operates a range of other credit and identification management options, in addition to recording the three credit reports and credit ratings for alterations that indicate identity fraud.

Postal Service, watches for account acquisition and warns you via your social security number when any accounts are opened. Choose a package starting at $9.99 for one adult; one adult and up to 10 kids, starting at $14.99; or two adults and up to 10 kids, starting at $19.99. A 30-day free subscription is included with the plans, so you can determine whether you want to continue or terminate the service.

Paid vs. Free Credit Monitoring Services

There are a range of credit management systems that are paid and free and will help keep track of your credit. Many Americans have registered for free credit protection programs due to a series of high-profile data hacks, including Equifax in 2017 and Capital One in 2019.

However, if your personal information has not been revealed after a data breach and you are also unavailable for compulsory free credit monitoring, alternative free tools and paid solutions are available to explore. Check a range of alternatives to see and what is not offered and decide the right credit management program for your needs.

Experian, for instance, provides two options for credit monitoring: CreditWorksSM Basic and CreditWorksSM Premium. The standard package is free to use, while the subscription is currently $4.99 a month for the first month, then $24.99 per month. Different services are offered under both plans.

FAQ’s

How much Credit Monitoring Services Cost?

Costs for Credit Monitoring Services have differed. Few businesses provide free access, while others can only offer free trials with subscriptions. Generally, companies with more tools and robust functionality charge more money. Depending on the number of users and included, these payments usually vary from $9.99 and $34.99 per month.

How to stop scams with credit monitoring Services?

People fall way too frequently into credit tracking scams that leave their identities exposed and money spent on them. It’s important to be conscious that there are these scams. Be sure that you know the fees upfront, research the company, look at the favorable and bad feedback, see how long it’s been in business, and go with your gut. It’s definitely a con if it seems suspicious, has misspelt terms, or sounds too amazing to be true.

Will my credit be impacted if I check it?

It’s a common misconception that monitoring your credit score will negatively impact your credit record; however, this is untrue. A soft inquiry, such as checking your own credit score, has no impact on your credit. A hard inquiry, which can lower your score by many points, is when you apply for a loan or credit card and the firm performs a credit check on you.

Does the Credit Karma app offer free credit monitoring?

Yes! The Credit Karma app offers free credit monitoring from Credit Karma. You will have the choice to get credit alerts anytime we discover significant changes on your credit reports if alerts and push notifications are enabled on your app.

What other needs does credit monitoring have?

It’s vital to realise that credit monitoring can only detect behaviour that shows up on your credit reports, even while it aids in keeping a check on your credit. It can’t notify you of things like unauthorised attempts to withdraw money from your bank account that might not appear on your credit reports. Also, it can’t tell if someone is trying to use your Social Security number to file a tax return and get a refund that is rightfully theirs.

Conclusion: Is Credit Monitoring Valuable?

Credit monitoring services are important tools for maintaining the accuracy of your personal data and credit reports. In addition to assisting you in keeping tabs on changes to your credit score and credit report, these organisations safeguard you from identity theft and other potentially harmful breaches of your personal information. ID theft will become more and more prevalent as technology develops. By working with a credit monitoring company right away, you can stop any breaches from happening and stay on pace to keep your credit score healthy.

You may simply pick a package that fits your budget and credit monitoring demands because credit monitoring companies provide them in a variety of price ranges. Because of this, we don’t see any justification for not using these services, since doing so might end up saving you a lot of time, aggravation, and money.